south dakota property taxes by county

For more details about the property tax rates in any of South Dakotas counties choose the. For instance if your home has a full and true value of 250000 the taxable value will add up to 250000 multiplied by 085 212500.

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would be 85.

. This is the value upon which your South Dakota property taxes are based. Then payments are paid out to these taxing entities based on a predetermined plan. South Dakota Property Taxes Go To Different State 162000 Avg.

The amount is based on the assessed value of your home and vary depending on your states property tax rate. South Dakota law gives several thousand local governmental districts the power to levy real estate taxes. 108 1st Street East PO.

Karthik saved 38595 on his property taxes. The average property tax rate in South Dakota is 118 and the average property taxes paid is. Yet property owners most often pay just one consolidated tax bill from the county.

Property taxes account for the majority of the revenue in the county budget. Assessor Director of Equalization. The Treasurer is not only responsible for collecting property taxes for the county but the city and school districts as well.

South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County. Counties in South Dakota collect an average of 128 of a propertys assesed fair market value as property tax per year. Property tax bills are sent out to property owners in the county based on their individual home value assessments and the current tax rate.

I had a fantastic experience getting my property tax deal processed through TaxProper. South Dakota SD Sales Tax Rates by City. The median property tax in Hand County South Dakota is 910 per year for a home worth the median value of 74900.

They do not become delinquent if one-half of the taxes are paid before May 1 and the remaining half paid before November 1. Property Search and Mapping. Property taxes or real estate taxes are paid by a real estate owner to county or local tax authorities.

128 of home value Tax amount varies by county The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000. The six counties with the highest median property tax payments all have bills exceeding 10000Bergen Essex and Union Counties in New Jersey and Nassau Rockland and Westchester counties in New York. Median property tax is 162000 This interactive table ranks South Dakotas counties by median property tax in dollars percentage of home value and percentage of median income.

Hand County collects on average 121 of a propertys assessed fair market value as property tax. Where Do People Pay the Most in Property Taxes. Sales Tax Calculator Sales Tax Table.

The process was simple and uncomplicated. All six are near New York City as is the next highest Passaic County New Jersey 9881. The state sales tax rate in South Dakota is 4500.

SDCL 10-24-5 Person can redeem property bid off by county at any time before tax deed is issued. A home with a full and true value of 230000 has a taxable value 230000 multiplied by 85 of 195500. Determine the Tax Levy for All Taxing Jurisdictions Which can Tax Properties.

2020 rates included for use while preparing your income tax deduction. South Dakotas constitution also reads that landowners have a right to compensation determined by a jury and payment prior to entry of their land according to the lawsuit. South Dakota is ranked 1647th of the 3143 counties in the United States in order of the median amount of property taxes collected.

All property taxes are paid to the county. The latest sales tax rates for cities in South Dakota SD state. Article 17 Section 18.

Corson County Director of Equalization. The next step in deciding your South Dakota property tax bill is. Also compare SDCL 10-23-27 10-24-1 and 10-24-5 SDCL 10-24-6 Payment of subsequent taxes by owner while county holds certificate see 1935-36 AGR p.

Taxes Tax bills are sent to property owner. Box 258 McIntosh SD 57641. Taxes are due and payable January 1 of the year following assessment 2012 assessment taxes are due and payable January 1 2013.

The list is sorted by median property tax in dollars by default. Motor vehicle fees and wheel taxes are also collected at the County Treasurers office. You can sort by any column available by clicking the arrows in the header row.

Rates include state county and city taxes. Lawrence County Property Tax Exemptions Report Link httpwwwlakesdgovcustomequalization View Lawrence County South Dakota property tax exemption information including homestead exemptions low income assistance senior and veteran exemptions applications and program details. TaxProper did a great job answering any questions I had about the process and their service.

With local taxes the total sales tax rate is between. I would recommend them anytime for tax appeal needs. Search Corson County property tax and assessment records by name address parcel ID or search parcel map.

Homeowners have to pay these fees usually on a monthly basis in combination with their mortgage payments. Must pay all taxes due even if not delinquent.

This Map Shows How Taxes Differ By State Gas Tax Healthcare Costs Better Healthcare

Thinking About Moving These States Have The Lowest Property Taxes

State Corporate Income Tax Rates And Brackets Tax Foundation

States With Highest And Lowest Sales Tax Rates

Property Taxes By State In 2022 A Complete Rundown

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Property Taxes How Much Are They In Different States Across The Us

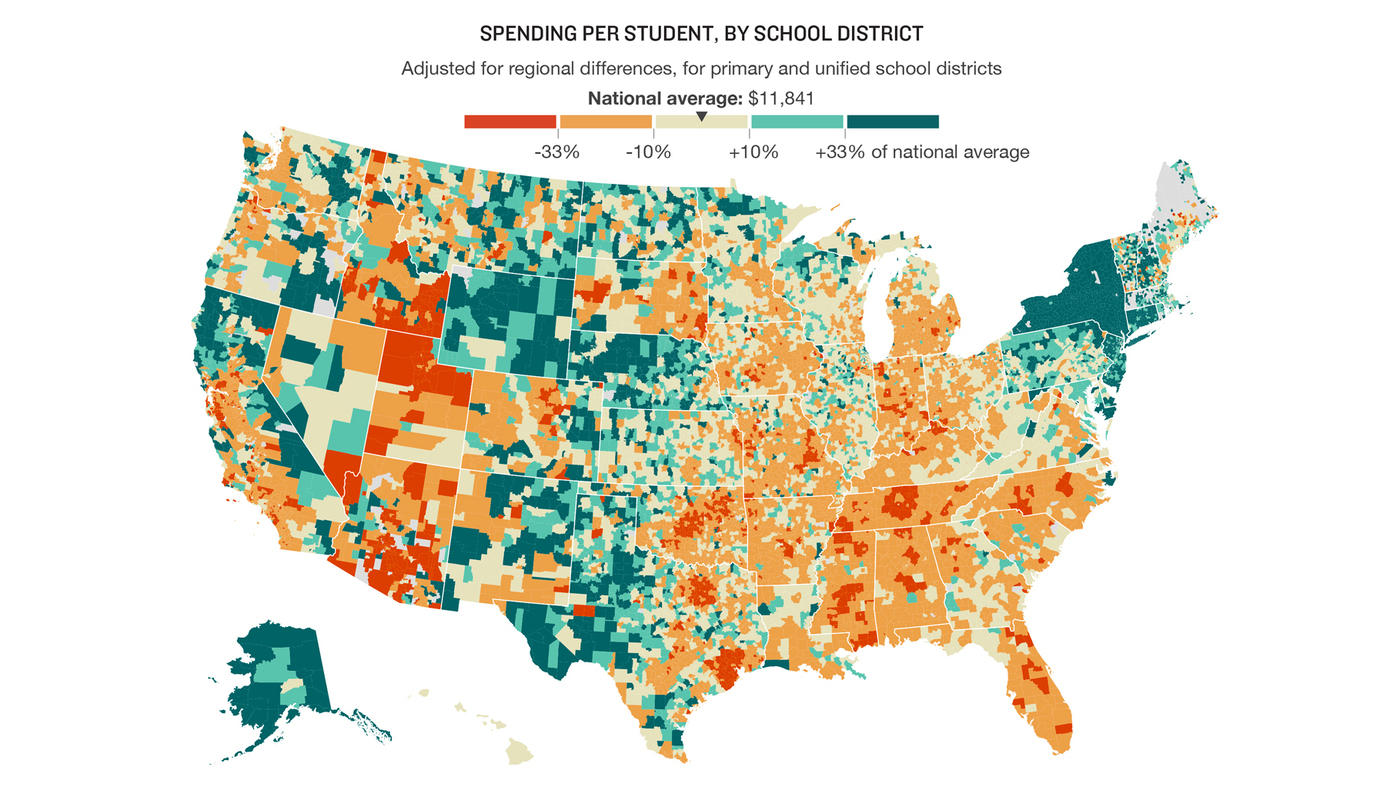

How School Funding S Reliance On Property Taxes Fails Children Npr

South Dakota Property Tax Calculator Smartasset

Property Tax South Dakota Department Of Revenue

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

States With The Highest Property Taxes Gobankingrates

Property Taxes By State In 2022 A Complete Rundown

2022 Property Taxes By State Report Propertyshark

Tax Information In Tea South Dakota City Of Tea

South Dakota Property Tax Calculator Smartasset

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation